The Jobless Boom

The US labor market is sick, hiring is frozen, manufacturing is already in recession, and inflation is stuck at the high 2s.

Introduction

The US labor market is sick, hiring is frozen, manufacturing is already in recession, and inflation is stuck at the high 2s.

In this report, we start with inflation and why the right word for it is “tame”: PCE has been stable since early 2024, Truflation is pointing toward much lower CPI ahead, housing is showing classic deflationary freeze dynamics (transactions seize up before prices fall), and energy prices remain a disinflation tailwind. Then we turn to jobs, where the story is quietly deteriorating: the economy is in a “hiring recession,” job growth outside healthcare and hospitality is weak, unemployment is drifting higher, and employment growth has slowed to levels that have historically preceded recession. We end by tying it together: recession risk hinges on when labor weakness finally hits household budgets and spending, and why the AI capex boom that supported growth may be losing steam.

Inflation Analysis

Latest PCE Data

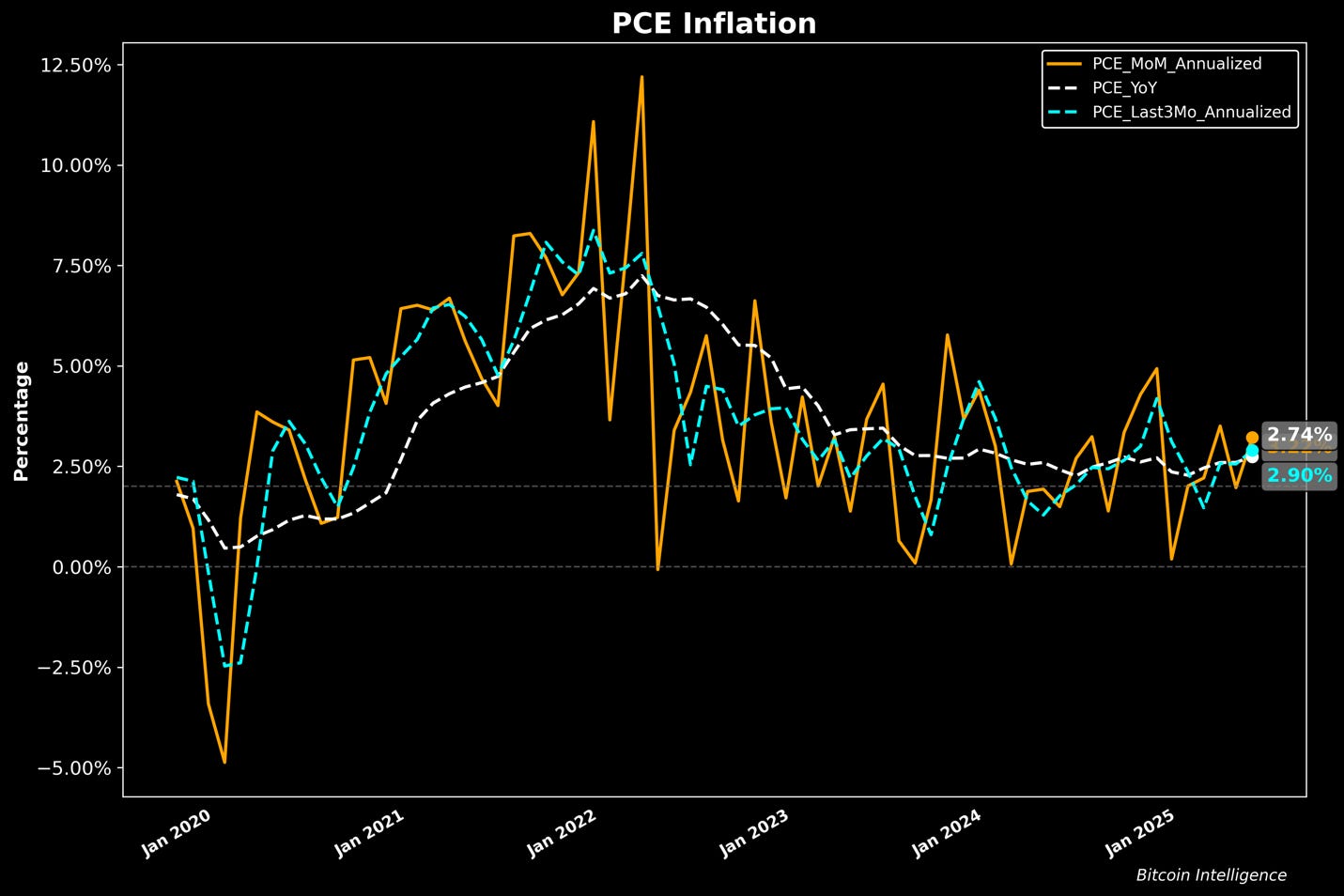

As usual, our macro analyses start with analyses of inflation and the labor market. Looking at inflation, the one word that summarizes it is “tame”. The latest inflation data came out tame and stable, with PCE at 2.7% YoY and 2.8% MoM annualized. Both figures show a tiny rise from the last report, but the trend remains stable. As you can see in the chart below, inflation really has not changed since Jan 2024. The blue curve also helps visualize the recent trend: in the last three monthly reports the average MoM PCE rate was 2.9% suggesting no short-term trend change. Two years of stable inflation completely invalidates the fears of an inflation resurgence that many were highlighting.

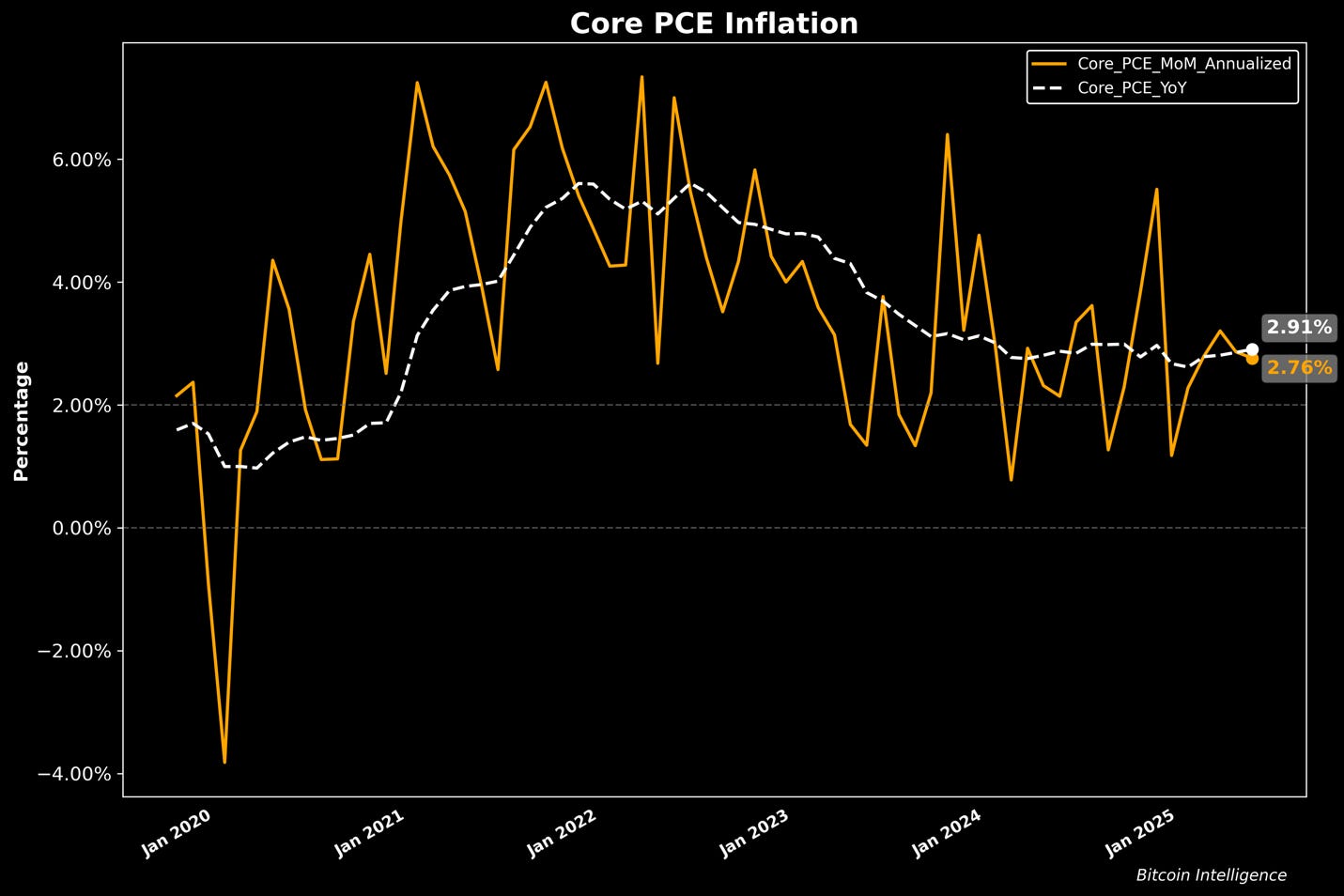

Core PCE came in at 2.9% YoY and 2.76% MoM annualized. This figure has also largely remained stable since Jan 2024 and suggests that inflation is stable.

So this assuages worries of an inflation resurgence but would it go down further toward 2%? What we see across the economic data is that there are no substantial inflationary force and rather trends are towards more deflation.

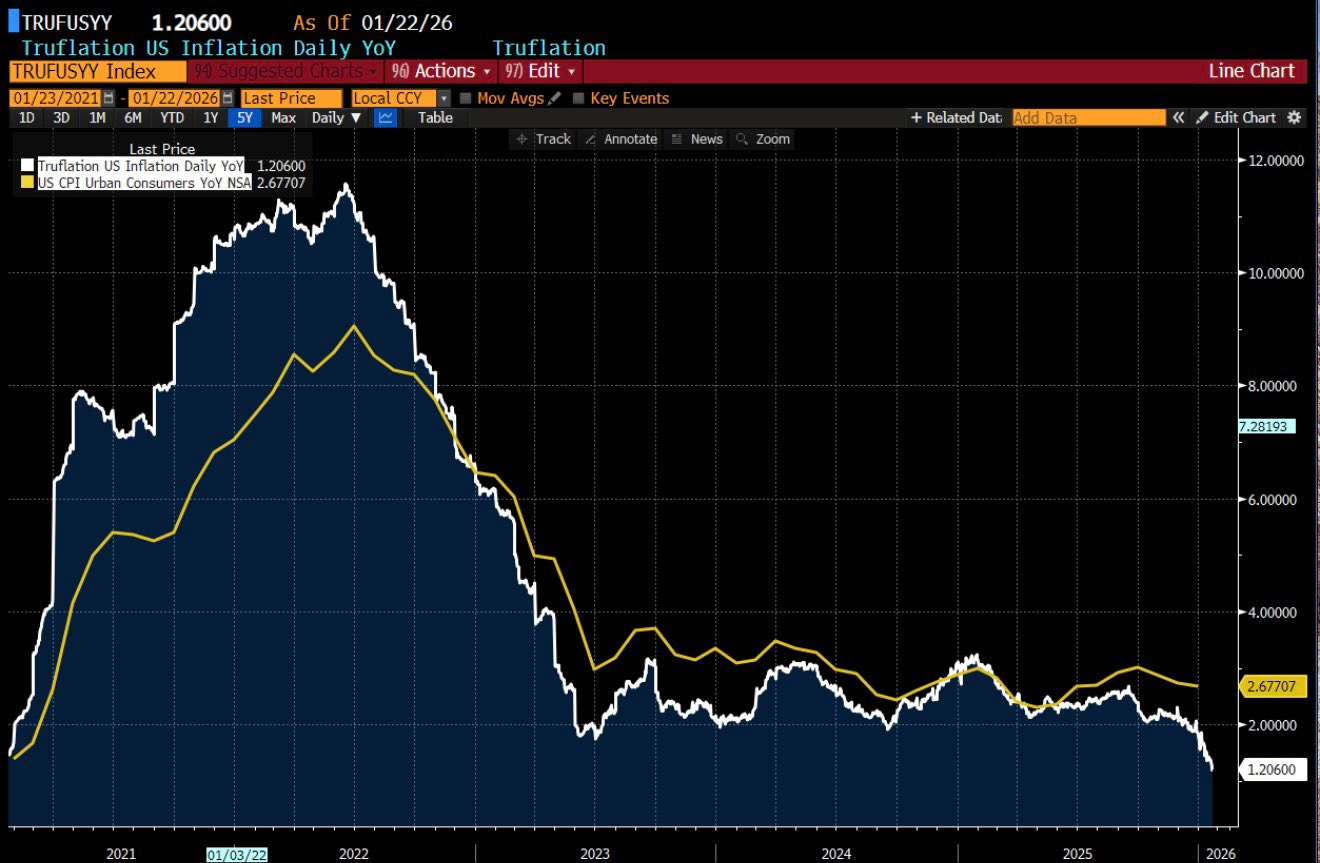

Truflation

For one, the private CPI index created by Truflation shows a pretty strong derop in inflation. According to them, US CPI Inflation has further dropped to 1.20% this week. Main drivers of this latest in a series of disinflationary coolings were Food (mostly Eggs), Household durables (particularly housekeeping supplies), and Alcohol & tobacco (mostly alcoholic beverages).

Their index is derived by aggregating millions of real-time price data points every day to calculate a year-over-year CPI % rate. It is comparable but not identical to the survey-based official headline inflation released monthly by the BLS, which is currently reported at 2.7% (December). Truflation is well correlated with CPI so it does suggest that the future past for CPI should be further down.

Housing Market Trends

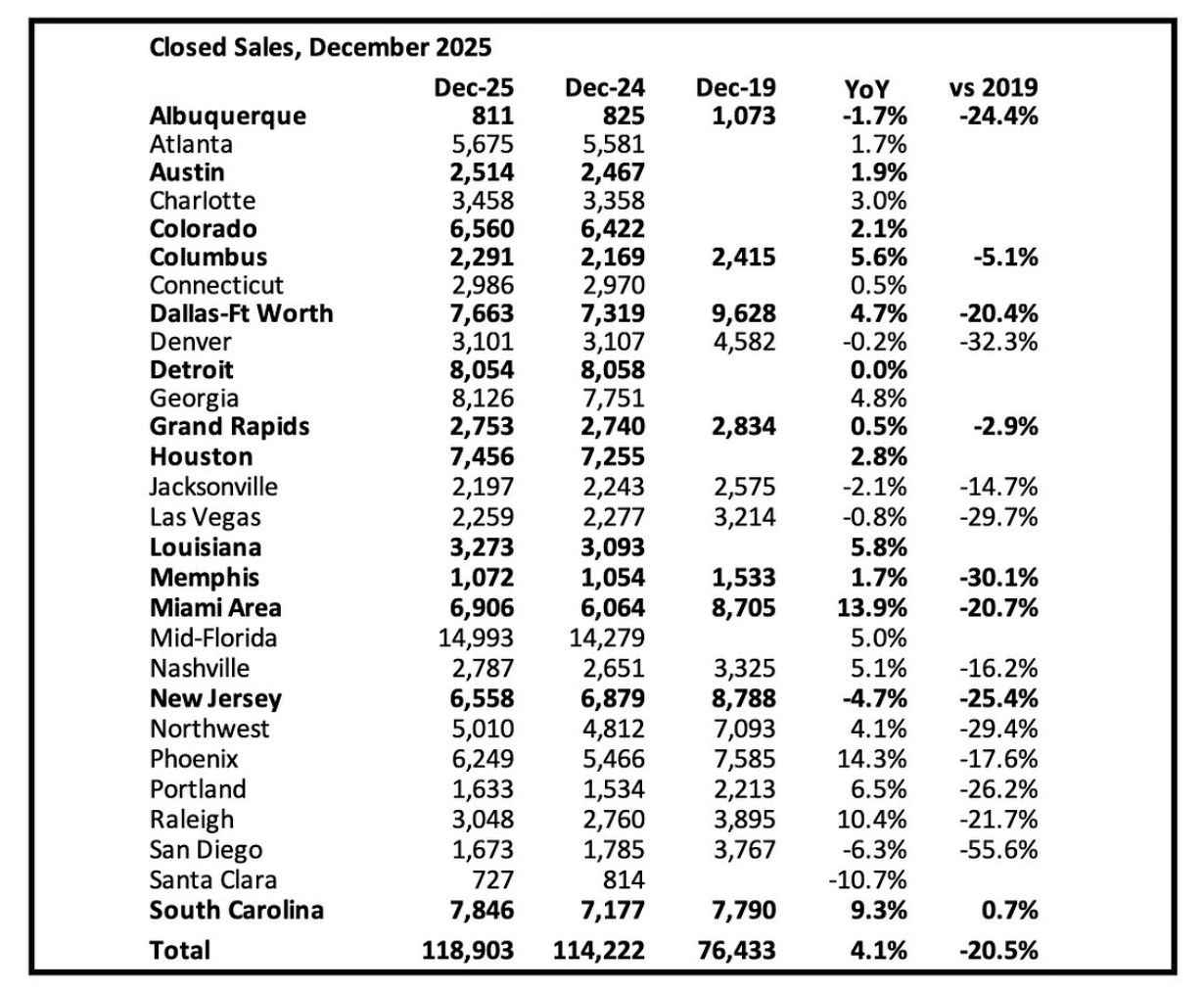

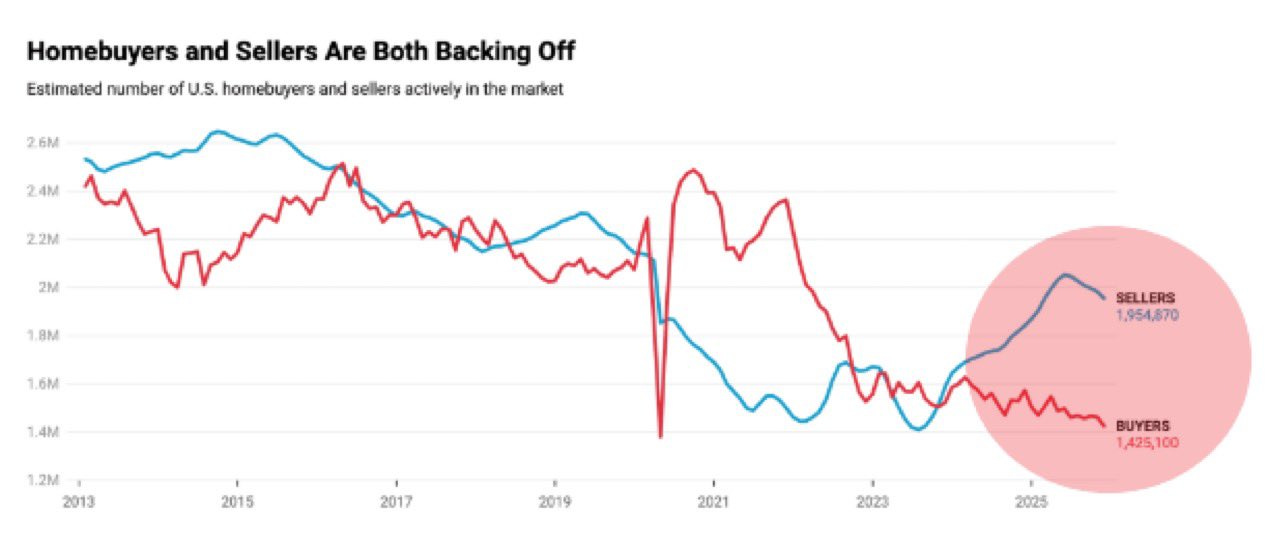

Deflationary dynamics in housing reinforce this point. Housing recession typically doesn’t begin with falling prices; it begins with a freeze in transactions and liquidity. Sales across major U.S. metros are 20.5% below 2019 levels. Prices will follow.

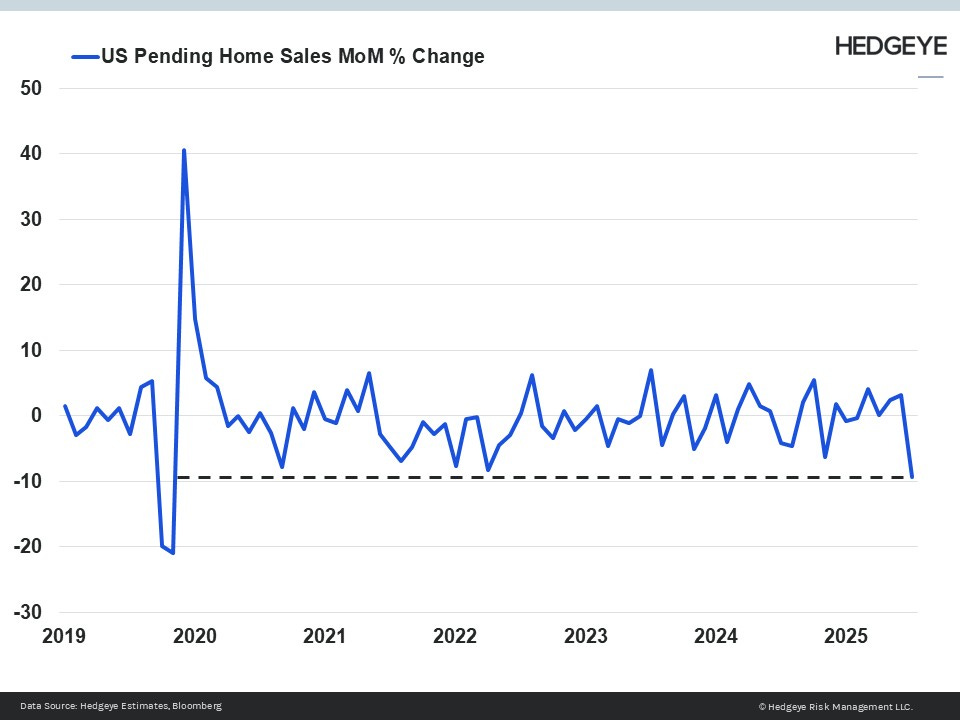

Looking at the MoM changes, US Pending Home Sales unexpectedly collapsed -9.3% month-over-month, far worse than the -0.3% expected decline. This marks the largest decline since the pandemic in 2020.

Furthermore, home sellers on the market now outnumber active buyers by 530,000, the largest gap ever recorded.

Housing has been one of the major contributors to the inflation in the last five years. Does the above trends suggest any appetite for investors to bid up house prices? As we have discussed in the past several reports, we expect housing deflation to trickle into the CPI over time, and push it down.

Energy Prices

What about energy? The charts below show the price of gasoline and crude oil in the past five years. Both, despite a slight bump in 2026, are at some of the lowest levels since 2021. The drop in the price of energy will also be another contributor to lower inflation.

So while one does not have a crystal ball to see the future of CPI or PCE, there are pretty important economic trends that could be examined to get a good sense of where inflation may be going.

Rate Cut Odds

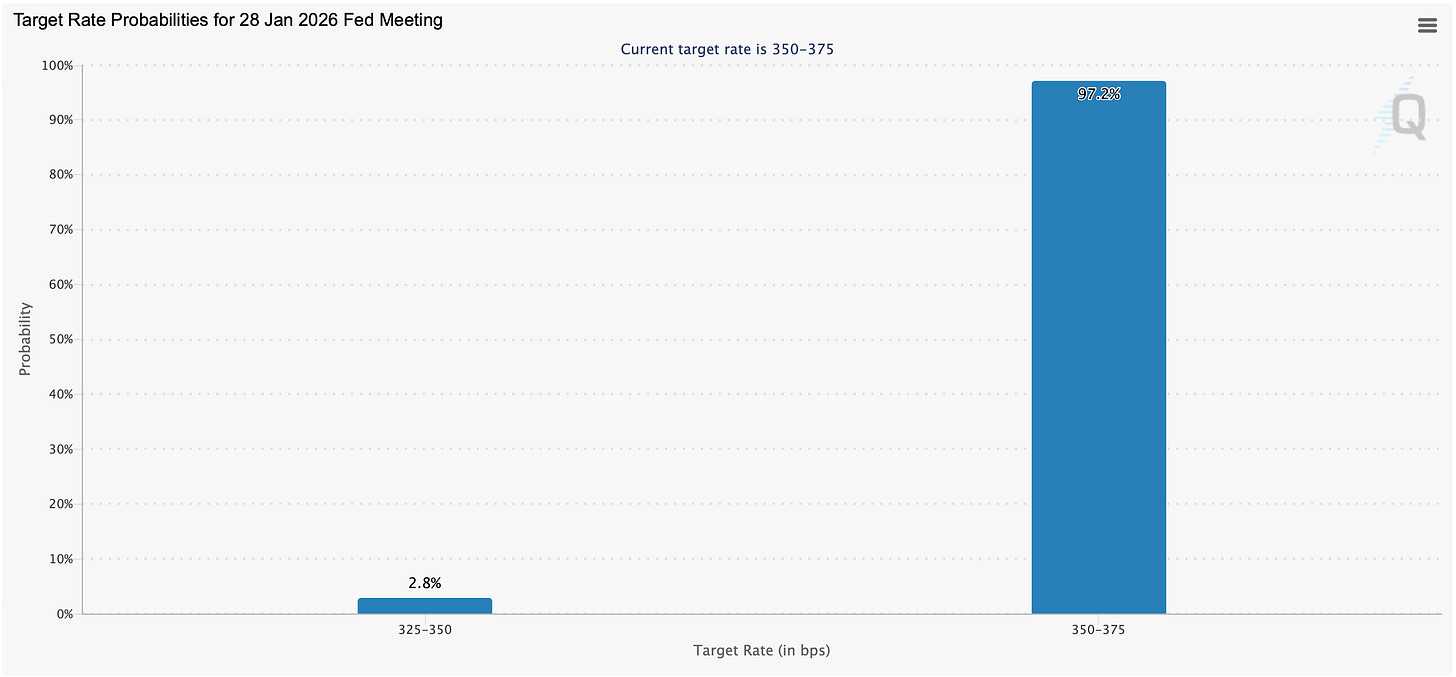

Currently the federal reserve board has a cautious stance and still considers inflation a problem. Given that they are reluctant to more cuts as of now. Traders are expecting the Fed to stay put in January 28th – only 2.8% chance of a rate cut is seen.

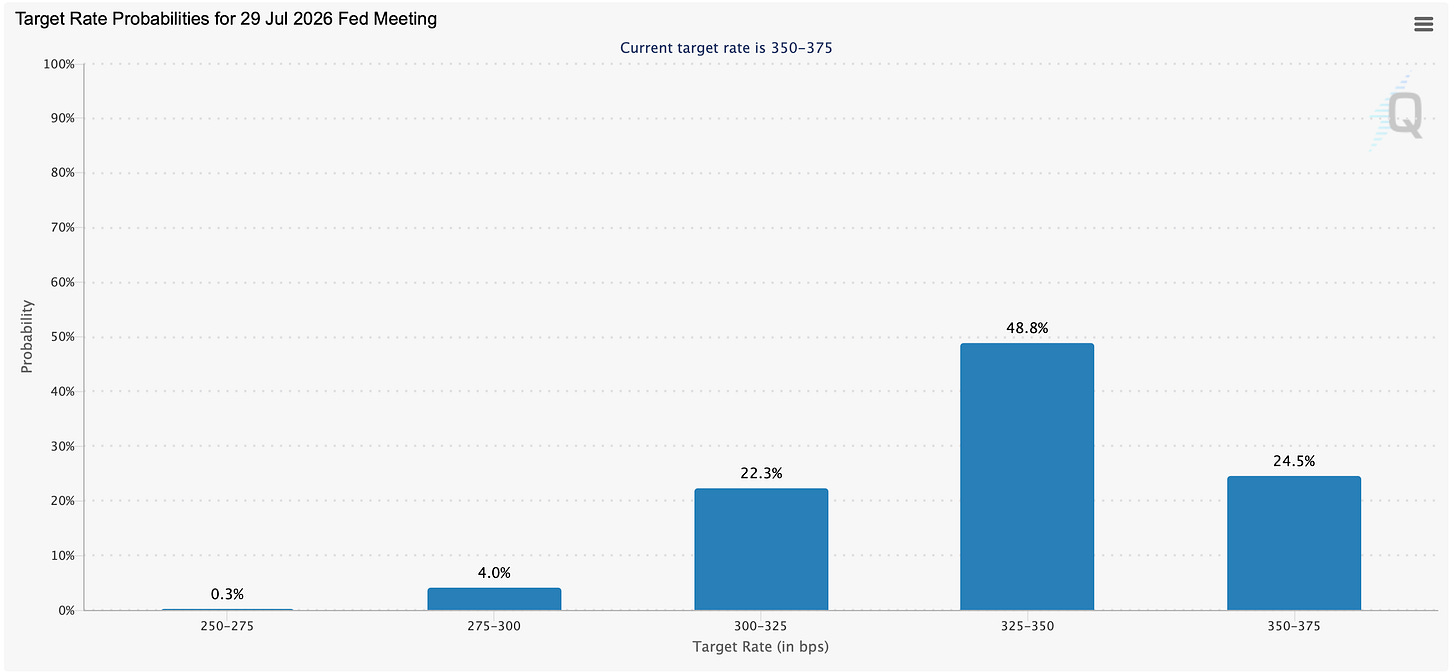

Additionally, they expect no more cuts until July! And only one cut on July 29th.

This market has become very pessimistic on rate cuts.

The Jobless Economy

Job Creation Stalled

The other side of the coin is jobs.

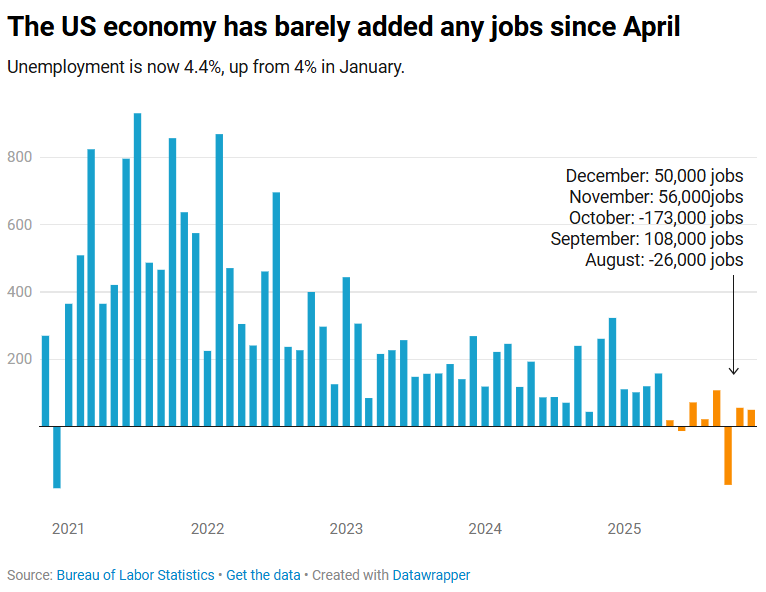

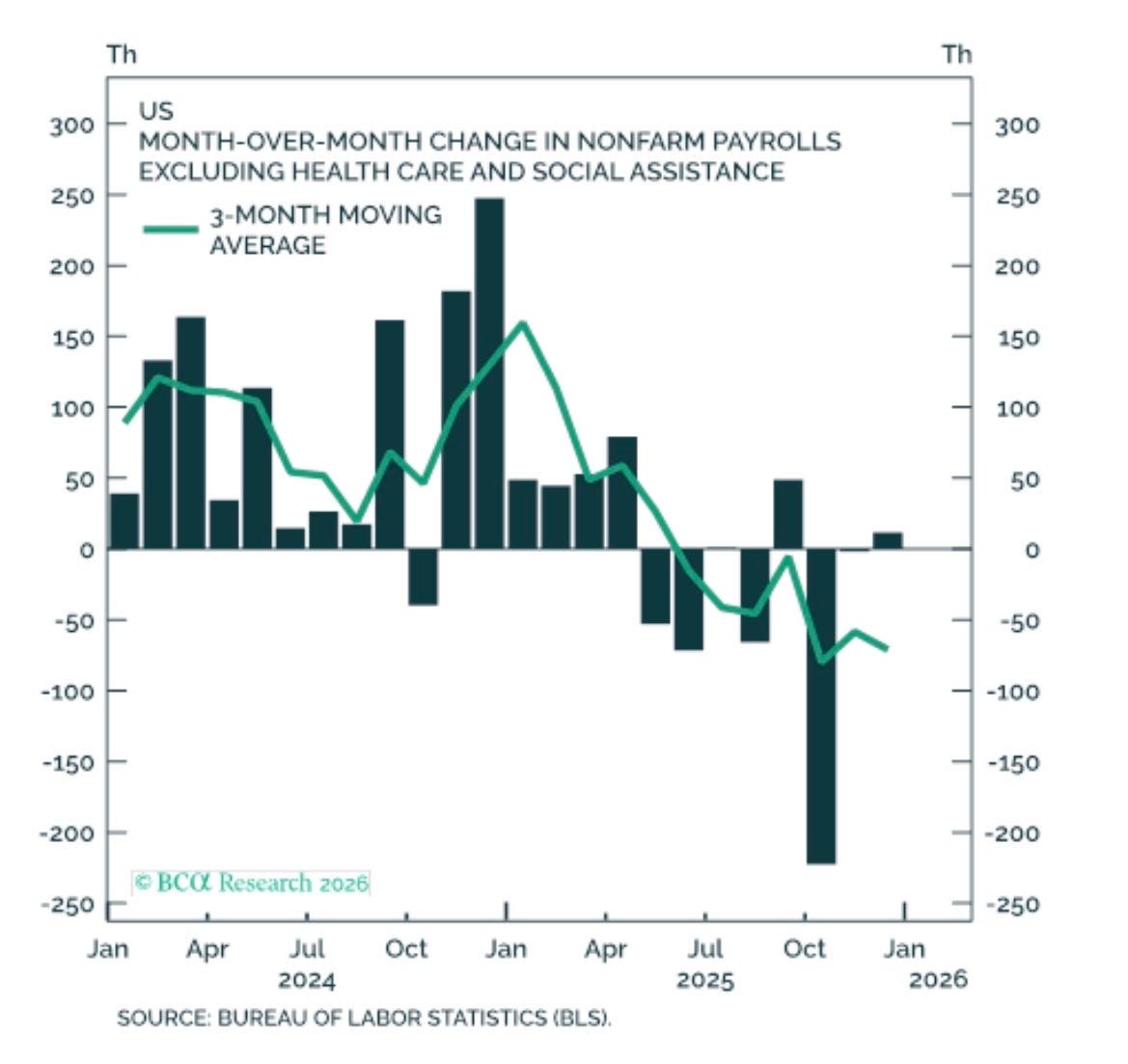

To sum it succinctly, the U.S. labor market is experiencing a jobless boom. Growth is strong, but there’s a hiring recession, with almost no hiring outside healthcare and hospitality. 2025 was the worst year for hiring outside of a recession since 2003. Hiring has been essentially flat since April. December is usually a decent month, so it’s hard to read 50k jobs added in December as any real pickup. And the BLS just revised October and November down by a combined 76,000.

The pictures gets substantially worse if we exclude healthcare and social assistance jobs which are unrelated to economic conditions.

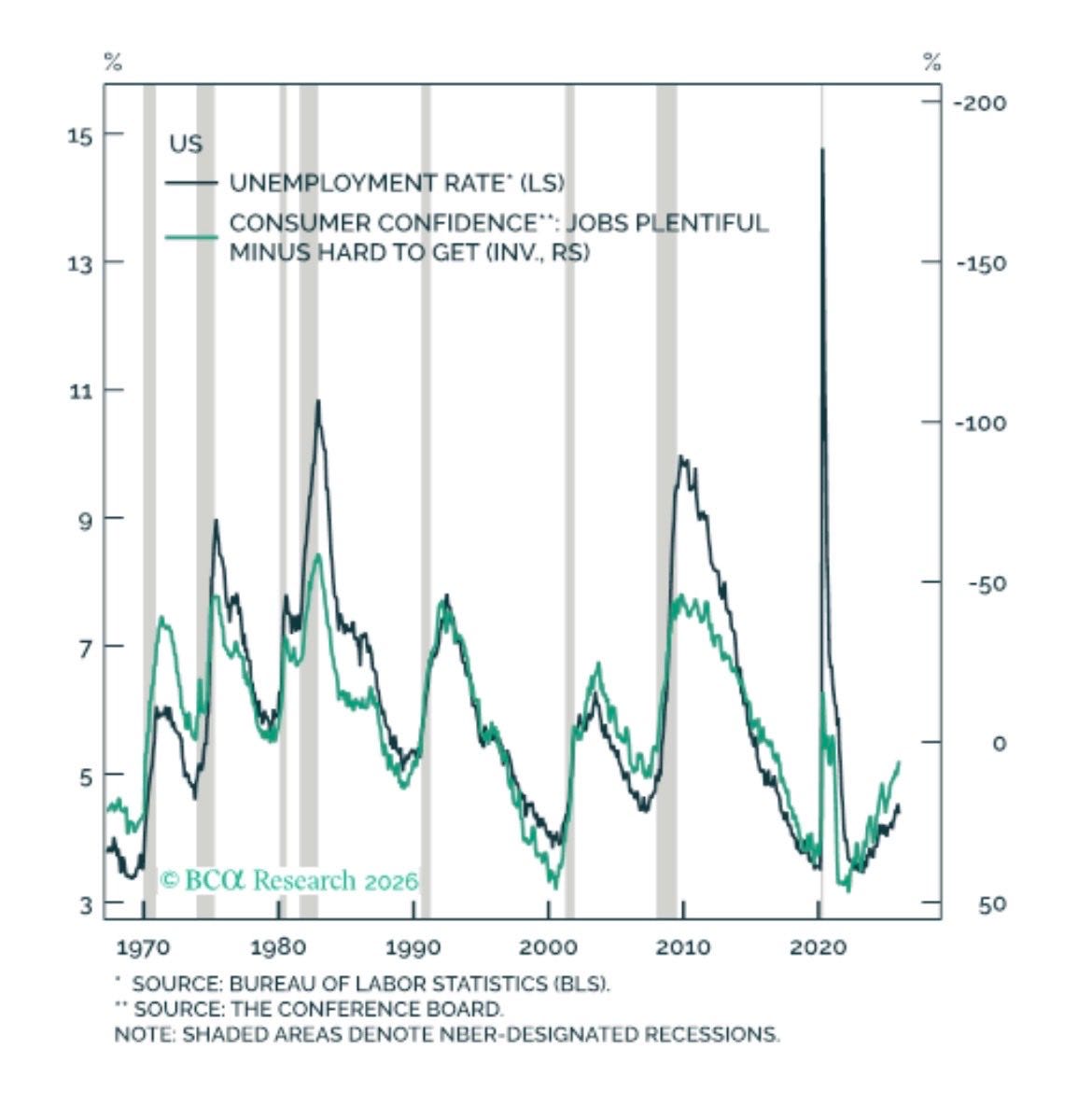

The U.S. labor market is still stuck in the mud. Both labor demand and labor supply are stagnant. Unemployment has risen to 4.4% and the share of survey respondents saying jobs are hard to get is increasing.

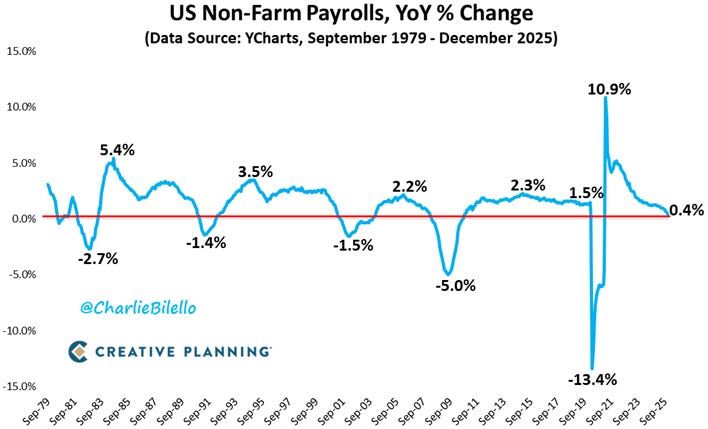

Total U.S. employment is up just 0.4% over the past year through December, the slowest growth since March 2021. Over the last 50 years, labor-market weakness at this level has been followed by a recession and a spike in the unemployment rate 100% of the time.

Does That Imply Recession?

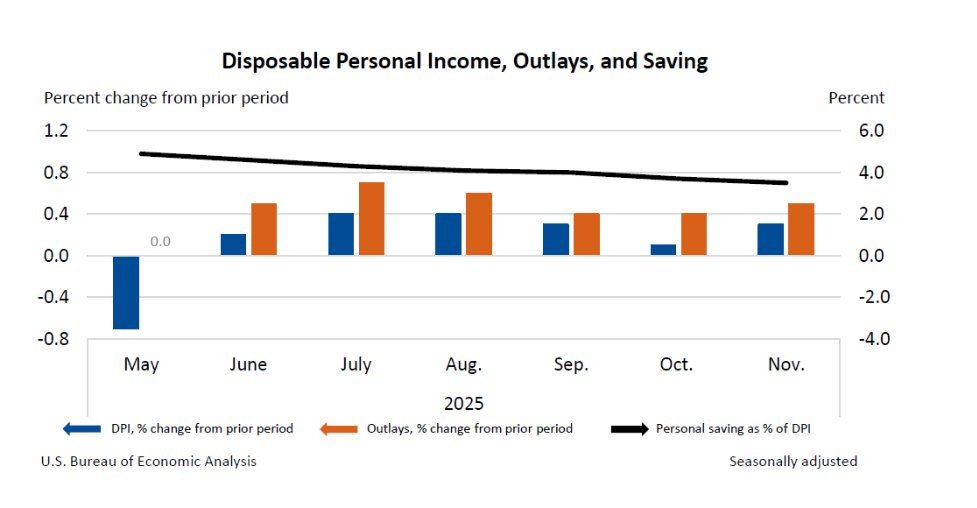

But recession won’t happen until household budget comes under serious stress and spending stalls. As of now, spending (orange bars) continues to be solid though and thus showing households have not yet ran out of dry powder. The holiday shopping data, especially at warehouse stores (e.g. Costco) and discount stores (e.g. TJ Maxx), also does not yet show major signs of strain on household budget.

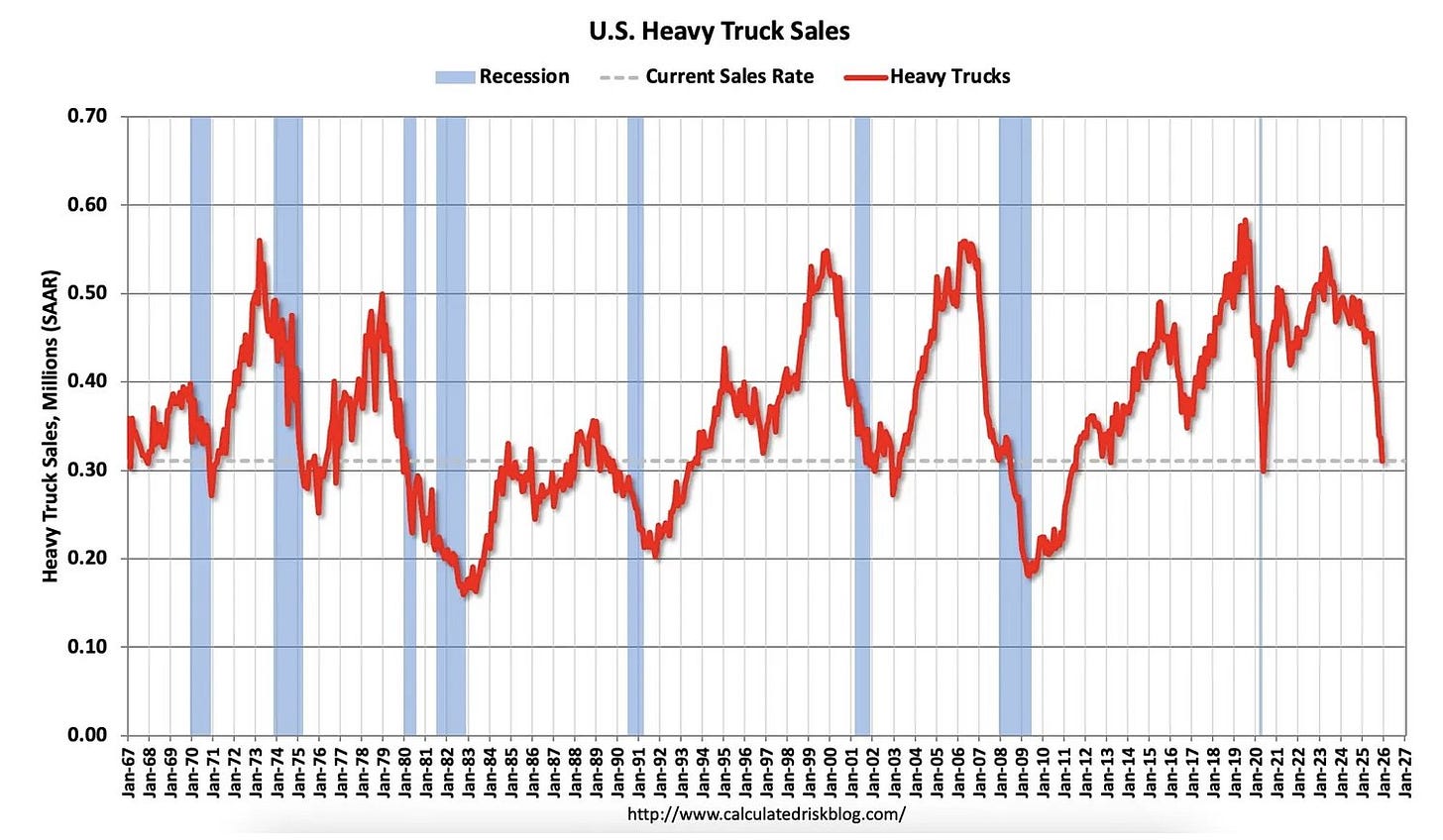

That said, the slowdown in spending may first appear in specific B2B areas such as heavy truck sales before it reaches consumers. Sales of Heavy Trucks are collapsing, which has usually foreshadowed an upcoming recession. Pretty much every time before an economic downturn we have seen this figure drop. The reason is simple: when manufacturing activity drops, there is less need (or financial capital) to invest in transportation. In this sense, transportation investments such as truck sales give us a leading indicator of the manufacturing economy.

Confirming this chart, statistics show that the US economy lost 68,000 manufacturing jobs in 2025. From a manufacturing standpoint the country is already in a recession. But remember manufacturing is only 1/3 of the economy and services are holding stable for now.

On the balance this data shows an ill job market. Jobs are becoming harder and harder to get and consumer confidence is eroding. If this trend continues, it is only a matter of time until this stress finds its way to the household budget and start impacting consumption.

The AI buildout in the last few years might have saved the economy but that is also running out of steam lately and there is chance that companies may start prioritizing ROI and investors stop throwing money at every unprofitable venture with AI in the name.

Conclusion

Stepping back, the macro picture is getting more challenging. Inflation isn’t resurging, it’s been stable since early 2024, and several forward-looking forces point lower. Truflation is already printing much cooler inflation, housing is flashing classic deflation mechanics (liquidity and transactions freeze first, then prices follow), and pending home sales just suffered a shock-sized drop. Energy prices, too, remain closer to post-2021 lows than highs, which keeps the inflation impulse muted.

Jobs are where the stress is building. Beneath the headline growth narrative is a hiring recession: 2025 was the weakest year for hiring outside of a recession since 2003, hiring has been essentially flat since April, and even December, typically a stronger month, only delivered 50k jobs, with prior months revised down. Ex-healthcare/social assistance, the labor market looks even more fragile. Unemployment is drifting up, “jobs are hard to get” is rising, and total employment growth has slowed to 0.4% YoY, levels that, historically, have preceded recession and a jump in unemployment.

The key question is timing. A recession usually doesn’t become inevitable until household budgets finally crack and spending rolls over. For now, consumption is still holding up and holiday demand hasn’t collapsed. But the early warning lights are showing up in more cyclical, B2B corners first, like heavy truck sales and manufacturing, where job losses already suggest recession-like conditions. If labor weakness continues to widen, it’s only a matter of time before it reaches households and drags down consumption.

And that’s where the policy risk sits. Markets are increasingly pricing a Fed that stays tight for longer, even as the inflation problem fades and the labor market weakens. If the Fed waits for the damage to show up in the headline numbers, it may end up cutting only after the slowdown has already spread. Add the possibility that the AI buildout is losing momentum as firms shift from “AI everywhere” to ROI discipline, and the economy could lose yet another pillar of support.