Post Rate Cut Uncertainty

Highlights

The current cycle has extended over 1,030 days since the low, entering its third euphoric phase with >90% of supply in profit. However, diminishing returns and the absence of a sharp final leg higher suggest fragility in the ongoing rally.

Long-term holder profit-taking peaked in late July and briefly reignited around the FOMC rally to $117k, but at a smaller scale. The sizeable cumulative profits already realized could become the leading driver for a correction.

ETF netflows have slowed notably since late July, with only a brief FOMC-driven boost. Combined with mounting sell pressure around $70k–$100k entry levels and recent buyers above $117k, the odds of revisiting $111k appear stronger than breaking above $117k.

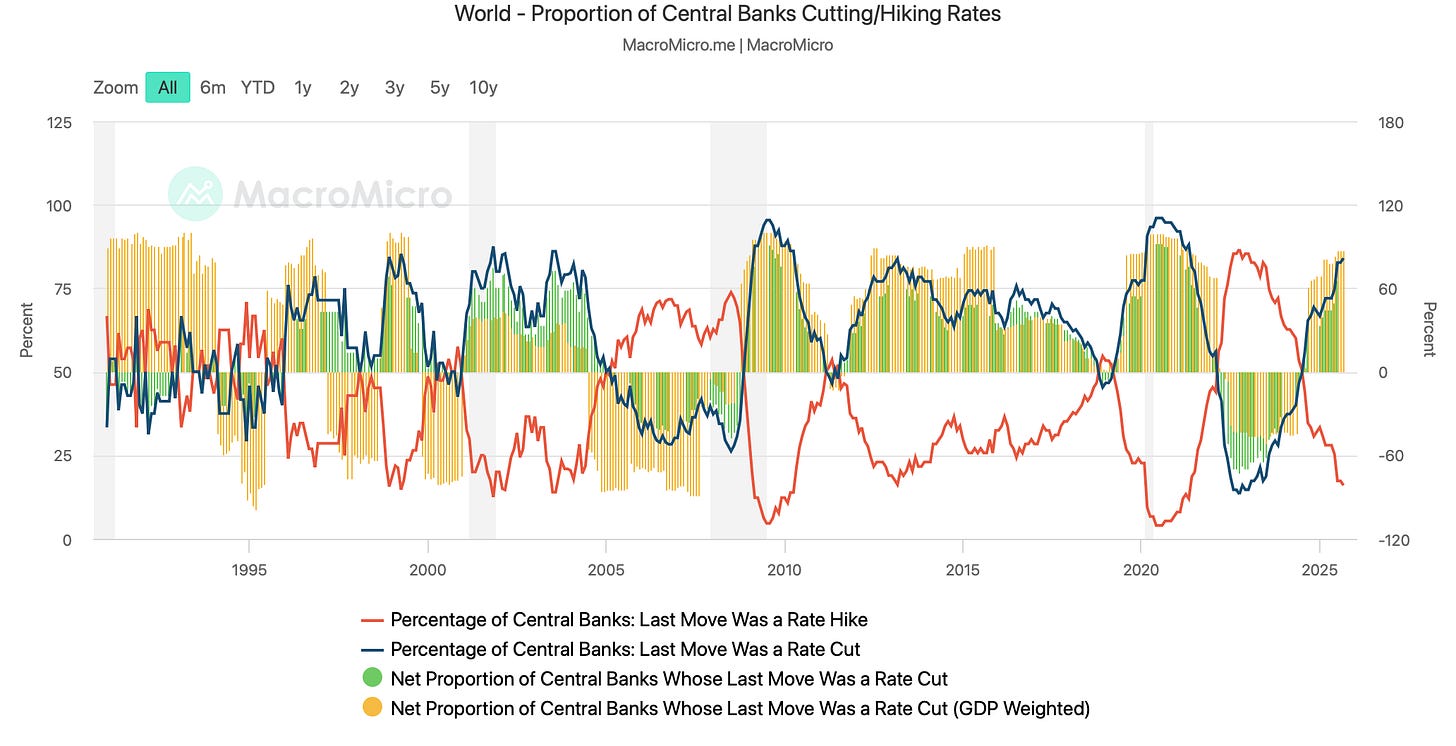

Global liquidity remains strong. 84% of central banks are cutting. rates.

Repo stability: Short-term funding markets remain calm, suggesting that systemic liquidity stress is low. This helps anchor risk sentiment.

Stablecoin collateral demand: Growing demand for stablecoins is reinforcing Treasury bill absorption, easing U.S. funding pressures while indirectly supporting Bitcoin liquidity.

Bitcoin in mortgage underwriting: Early signs show that Bitcoin is beginning to appear in collateral discussions for mortgage products, signalling its gradual integration into traditional credit markets.

SLR regulatory reform: Prospective tweaks to the Supplementary Leverage Ratio (SLR) could free up bank balance sheets, increasing Treasury market depth and indirectly boosting liquidity for risk assets like Bitcoin.

Introduction

So rate cuts are here. In the last couple of months, macro data has been driving Bitcoin. First, the downside surprise in July non-farm payroll led to lower bond yield expectations and drove Bitcoin higher. Then, CPI data showed sticky inflation, driving yields higher and Bitcoin lower. We repeated this process one more time in August, where a weak labor report drove Bitcoin higher and sticky inflation tempered expectations again.

As our on-chain analysis will show, demand remains weak for Bitcoin, and internal dynamics of the Bitcoin market are not going to be the next catalyst. Instead, the next leg up would be driven by a positive change in the macro landscape.

To allocate to risk assets, investors need reassurance that inflation is not a problem and that there will be a continual stimulus. Right now, globally many central banks (BOE, BOC, ECB, …). In fact, 84% of the central banks are cutting (i.e., their last move was a cut); this number has steadily risen since 2023. It is the cutting season. Global liquidity is strong, and yet, the US rate cuts remain a wild card for investors.

The effect of this rate was already priced in during the past month, and what will matter for Bitcoin is the future trajectory. The future path for cuts depends on the balance between the inflation reports and the labor data. If consumer price inflation does not surge, the Federal Reserve will continue on its cutting path, bond yields will drop, we will see signs of the resurgence of demand in the on-chain data, and Bitcoin will begin its next leg up. In the monetary mechanics section, we will discuss what will cause a resurgence of demand. Note: this article was written on Sunday, 4 pm Eastern Time; Bitcoin price: ~$115K.

Post-Rate Cut Uncertainty

Keep reading with a 7-day free trial

Subscribe to Bitcoin Intelligence to keep reading this post and get 7 days of free access to the full post archives.