Introducing the Bitcoin Momentum Model

A disciplined framework for recognizing regime shifts, reducing exposure to prolonged bearish conditions, and staying invested during sustained uptrends.

Introduction

Bitcoin has always been a market where momentum matters. Historically, Bitcoin has moved in powerful trends that rewarded those who respected momentum and punished those who ignored it. While many market participants intuitively understand this, few take the time to rigorously quantify it in a way that is both practical and robust.

This article introduces a systematic attempt to do exactly that. Drawing on nearly a decade of observing Bitcoin markets and a year of focused modeling work, I explore how momentum behaves in Bitcoin, why it plays such a dominant role, and how it can be transformed into a usable signal for navigating market cycles. The goal is not to predict exact tops or bottoms, but to better manage risk in an asset where volatility is the price of admission.

Momentum Investing

I have been closely observing Bitcoin price action for about a decade now and have always intuitively known the significance of momentum for Bitcoin. But never found the opportunity to properly research it. Now I had and the results are very exciting.

Momentum, in its simplest form, refers to the tendency of an asset’s price to continue moving in the same direction once a trend has been established. Rather than focusing on intrinsic value or fundamentals, momentum captures the persistence of buying or selling pressure over time, reflecting how market participants collectively react to recent price movements. In practice, momentum measures whether strength tends to lead to further strength, and weakness to further weakness.

Bitcoin is highly momentum-driven and reflexive. There are various reasons for that.

First, Bitcoin lacks traditional valuation anchors, which means price discovery relies heavily on expectations, narratives, and observed price action itself. Second, Bitcoin markets are globally accessible, trade continuously, and are dominated by speculative participants, making them especially sensitive to trend-following behavior. Third, leverage in derivatives markets amplifies directional moves, reinforcing trends once they start. Finally, Bitcoin’s relatively fixed supply and transparent issuance schedule intensify reflexivity: rising prices attract new demand, which pushes prices higher, while falling prices suppress demand and accelerate drawdowns.

And this momentum can be exploited to understand where the market is going, for portfolio risk management, and for long- or short-term investing decisions.

Momentum investing itself is not a new idea. Its roots go back decades, with early evidence appearing in commodity and equity markets long before modern quantitative finance. Academic research in the 1990s formally documented momentum as a persistent market anomaly, showing that assets that performed well over recent horizons tend to continue outperforming in the near future. Since then, momentum has become one of the most robust and widely studied return factors across asset classes, surviving different market regimes, geographies, and time periods. While the implementation details vary, the core insight remains the same: markets often underreact and overreact in predictable ways, creating exploitable trends.

However, in a world where everyone is or could be aware of general ideas, finding alpha is hard, as it should be.

Throughout last year, I have tried developing various models and applied various methodologies such as econometrics and machine learning with multiple approaches, but generally faced challenges that required significant time investment to solve and achieve a reliable and powerful metric. This holiday period gave me the opportunity to step back, refine the approach, and complete the final steps needed to evaluate its robustness to my own satisfaction. I am finally ready to debut the results.

The outcome is a metric derived from Bitcoin’s momentum calculated from the last several months of price action, combined with additional safeguards to minimize the impact of short-term noise. The result is a striking ability to identify topping and bottoming patterns, with the ultimate goal of improving investment risk management rather than chasing price alone.

Introducing Bitcoin Momentum Model

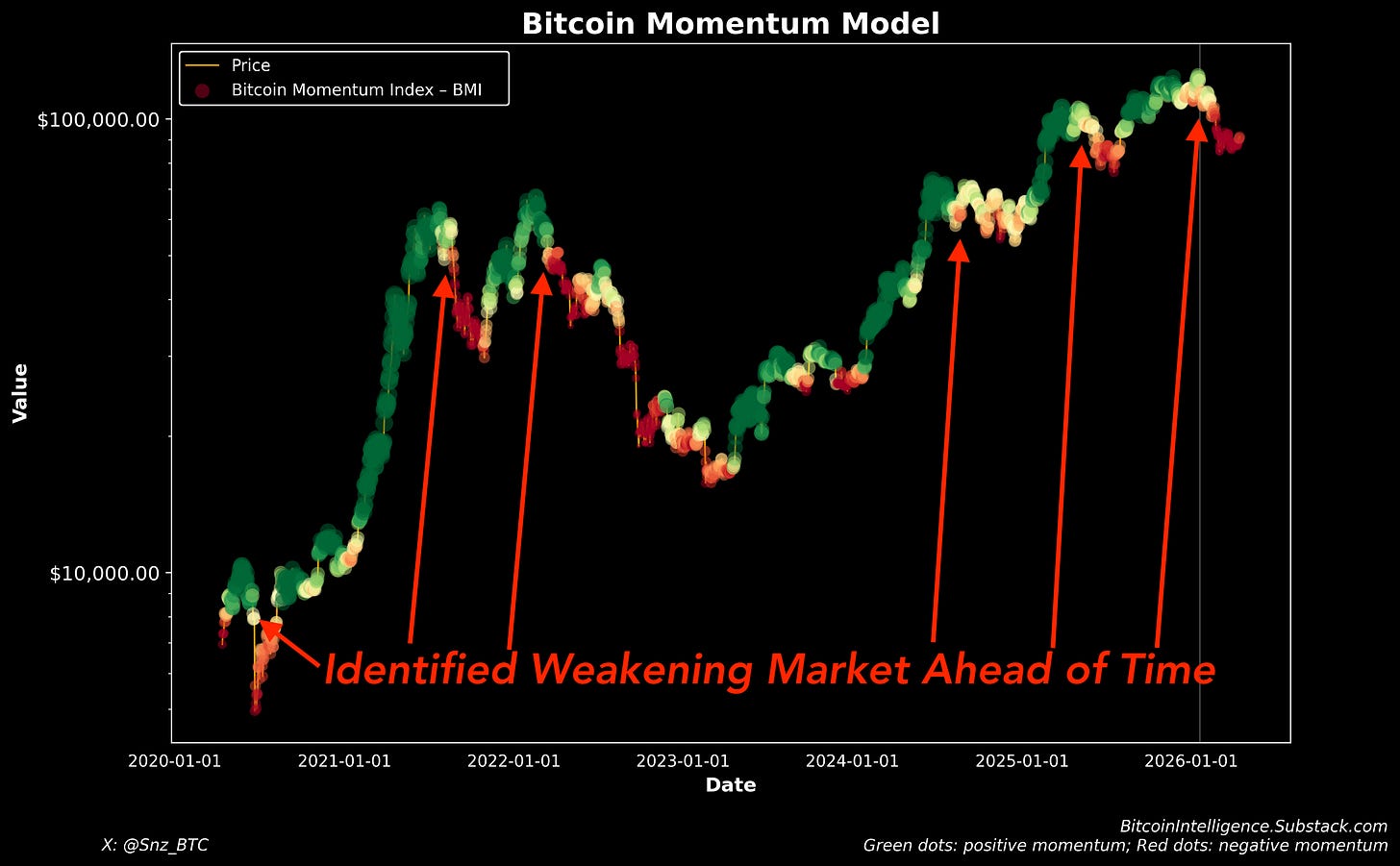

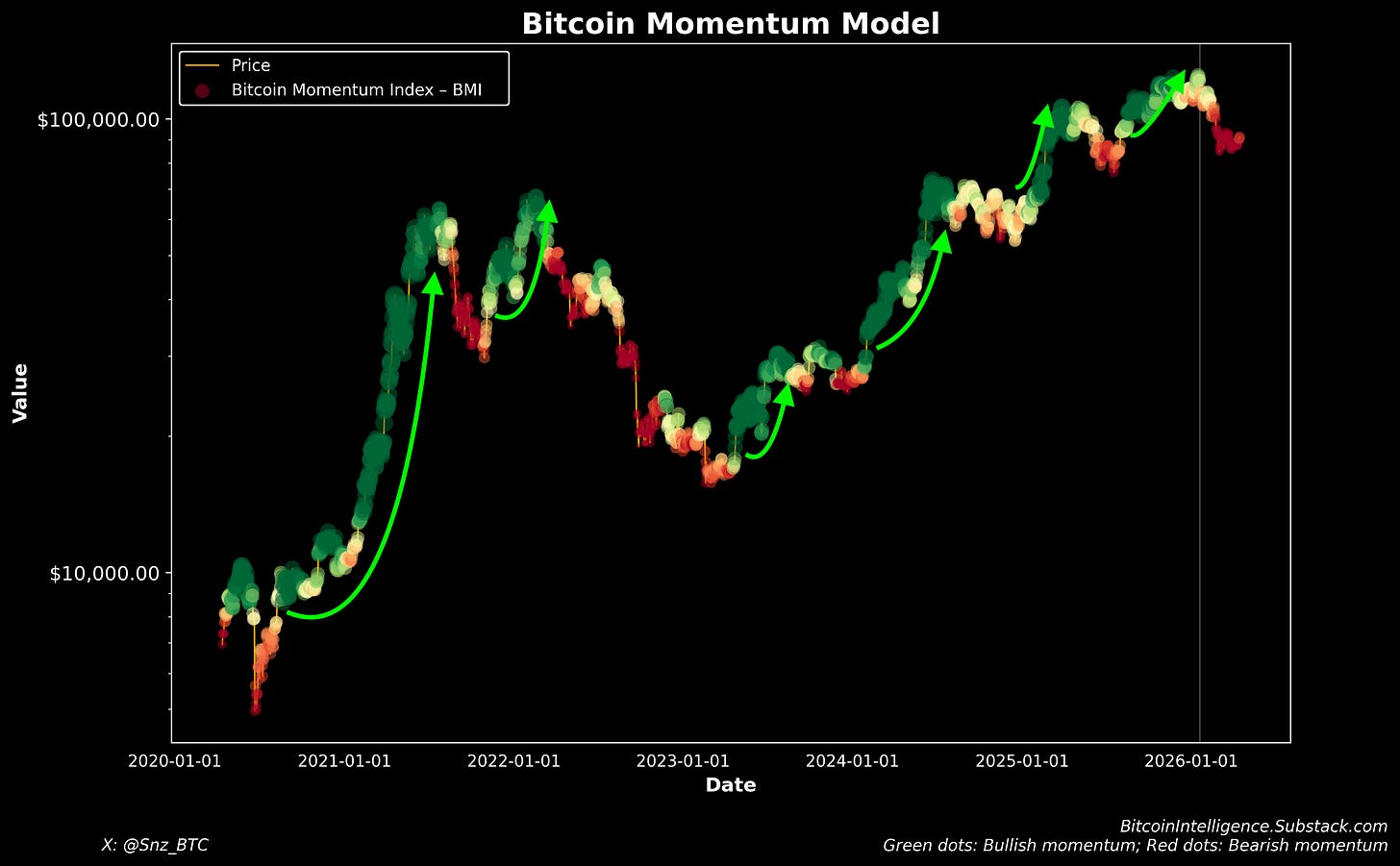

The chart below shows the performance of the momentum model against the full Bitcoin history. On any day, the model looks at the recent price action and calculates a momentum score, which we call Bitcoin Momentum Index or BMI.

Positive values show bullish momentum (green dots) and negatives show bearish momentum (red dots). And white(ish) colors show near zero momentum, which are typically transition zones.

Now, looking at the results, BMI is positive in most of the bullish periods and negative in most of the bearish periods. So if you followed it, it generally kept you in the market during the good times and out of it during the bad times.

I want to emphasize that, at any point in time, the model only sees the price data up to that point not the future datapoints. If we allowed it to see the future datapoints the predictions would be perfect (a very common trick or mistake on social media posts to create a perfect looking graph that is essentially useless for future prediction).

Let’s have a closer look at the data since 2020. The model would identify the weakening market ahead of timein most of the major crashes. It does not pick the pico tops, though. That is an impossible task. It rather waits to ensure the tides has turned for sure, and then triggers a bearish signal.

It also identified recoveries from the lows – again, ahead of time.

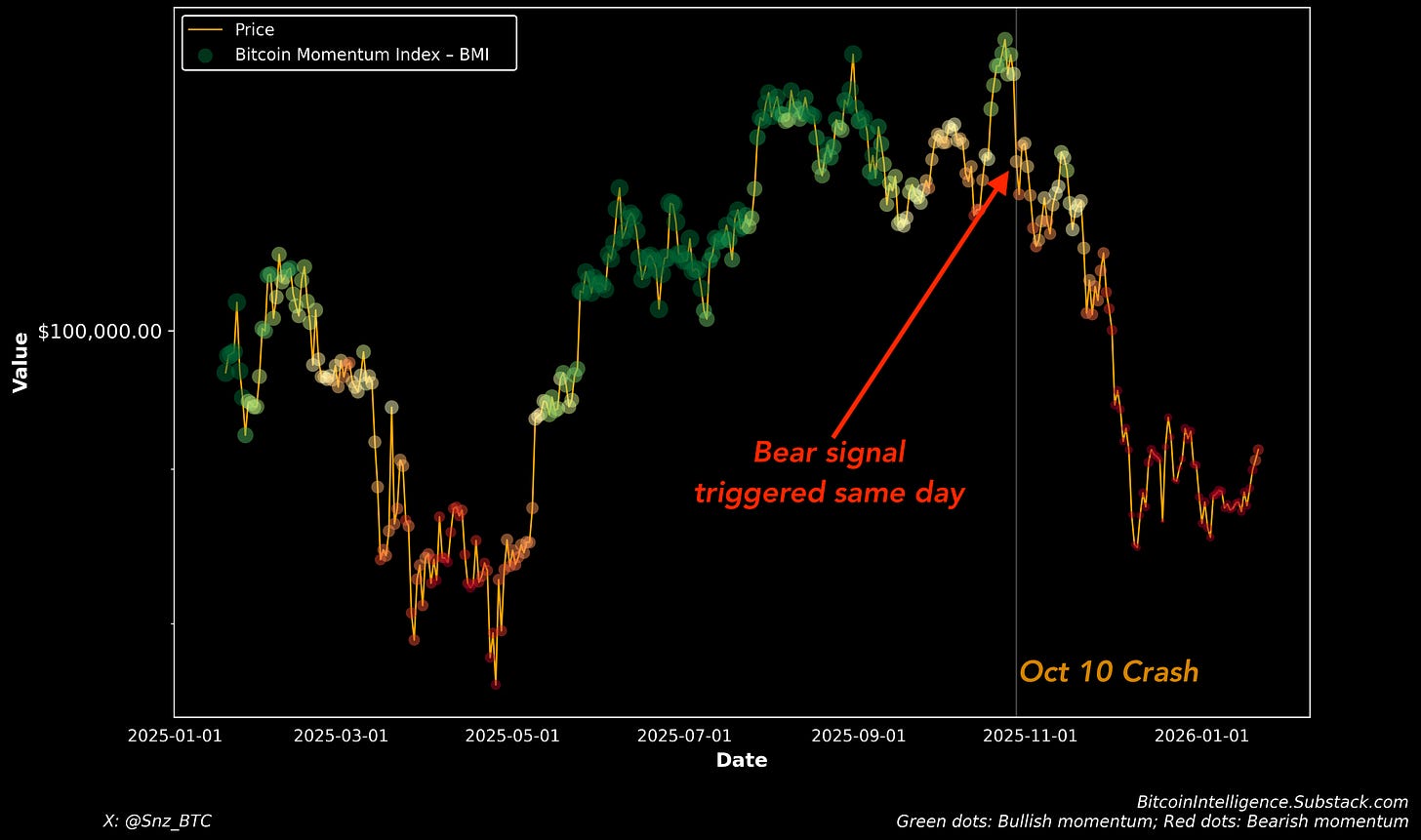

Now that is still a bit too long of a time window. Let’s take a closer look at the recent big crash that happened on October 10th, which kickstarted a heavy and sustained bearish period.

On the same day, after seeing the first drop in the price, the momentum signal turns negative, which is shown with a reddish orange color. The model also shows that after September 1st, the momentum markedly weakened and no more dark green dot was printed.

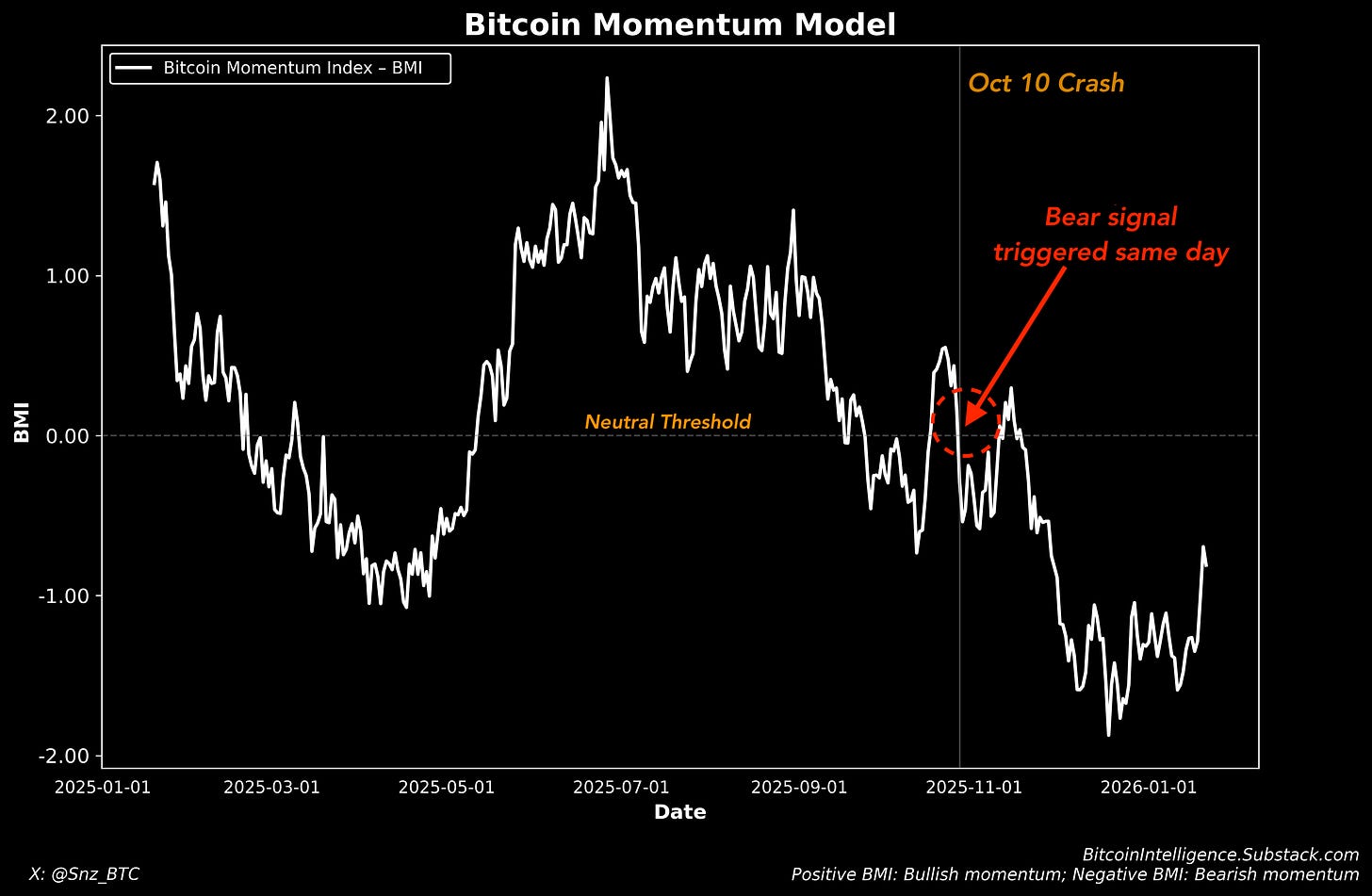

This chart shows how the value of BMI changed around the crash time. On October 10th, the value of the metric goes from positive to negative, marking the bear period on the same day it began.

There is a marked drop in momentum from September 1st. The model actually first flashed bear signals in September. Then after a fake-out briefly gets bullish and quickly goes back into being bearish on October 10th. So there are fake-out periods, but importantly, they get corrected quickly.

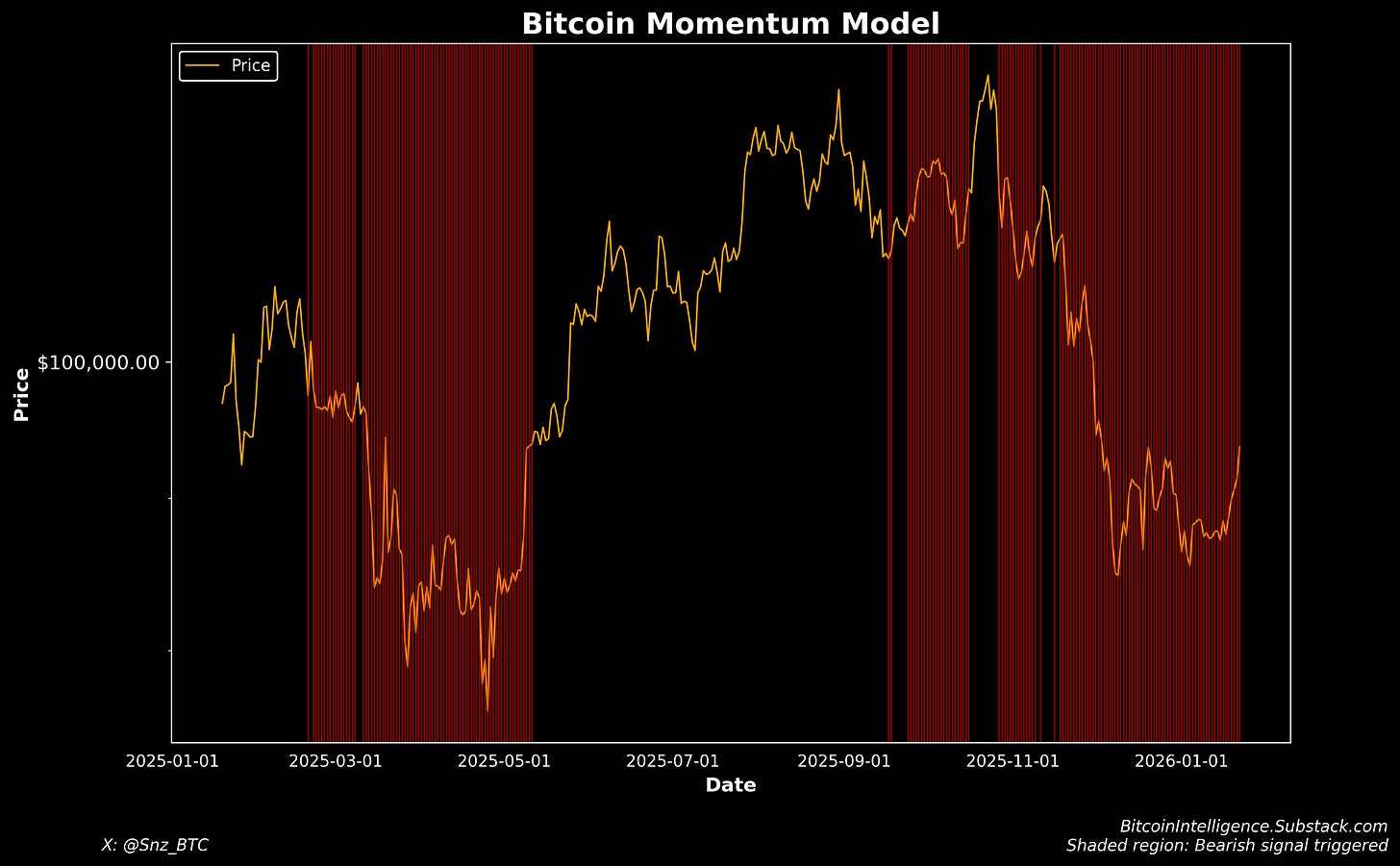

Now if you followed this metric, at what times would you have been bullish or bearish?

To answer this question, we drew a chart showing all the periods that the BMI signal is bearish. These regions are shaded in red. In the remaining periods, the BMI has been bullish.

The results are, in one word: protection!

The model protected you from the largest crashes and bear markets and kept you in the market during the uptrends.

How to access and use this metric?

First off, we will be publishing these results as part of Bitcoin Intelligence Report periodically and will make sure to report on future trend changes. However, real alpha cannot be openly made available or it will stop being alpha. So we will keep it exclusive to subscribers with free posts from time to time.

Second, how should you react to the results of the model? If BMI turns negative should you sell your Bitcoin? It all depends on your individual circumstances, risk tolerance, holding period and so on. As accurate as it is, a negative BMI does NOT guarantee a market crash ahead. But if there is one, it will start flashing red. Approach it as risk management tool to maximize your returns and minimize the downturns – a sign to take precautions. For some people it might mean selling an amount that you have been wanting to sell and taking the profit you have been sitting on. For others this could mean dropping portfolio allocation percentages, hedging via futures or options, or simply being more caution and avoiding leverage.

Third, to avoid false positives, you can use this in combination with another signal that you prefer to filter the main signal and only act if there is confluence of signals.

Conclusion

Bitcoin will always be volatile. That is not a flaw; it is a structural feature of a young, reflexive, and globally traded asset. What matters is not avoiding volatility altogether, but understanding when it is likely to work for you and when it is likely to work against you.

The Bitcoin Momentum Index is not meant to be a crystal ball. It does not promise perfect timing, nor does it eliminate drawdowns entirely. What it does offer is something far more practical: a disciplined framework for recognizing regime shifts, reducing exposure during prolonged bearish conditions, and staying invested during sustained uptrends.

Used correctly, this kind of momentum-based approach acts as protection and opportunity. It helps investors avoid the most damaging mistakes, overconfidence at market peaks and paralysis at market lows, while remaining aligned with Bitcoin’s dominant trends.

This work is ongoing. The model will continue to be refined, stress-tested, and contextualized within broader market conditions. For now, it represents a meaningful step toward turning an intuitive truth about Bitcoin into a practical tool for serious risk management.

We will keep finetuning this model and publishing our analyses at BIR.

Thank you for making it up to here.

how do I see the current up to date model as I am a paid subscriber?